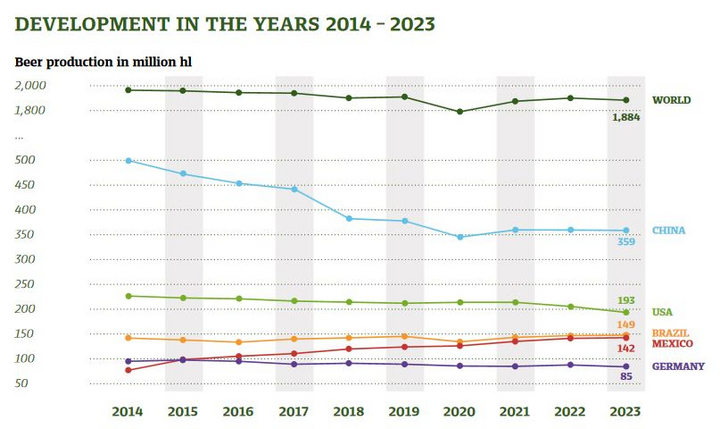

This means that hopes for a sustained recovery in the industry were not fulfilled. “After recording slight growth in 2022 despite adverse conditions, we also expected a small increase for 2023,” said Peter Hintermeier, Managing Director of BarthHaas, commenting on the development. “However, the costs of energy, raw materials, packaging, logistics and labor remained at a high level and had a negative impact on breweries' business in many countries.”

The German brewing industry performed worse than the global market as a whole: In this country, beer output in 2023 fell by 3.3 percent compared to the previous year to 84.89 million hl. “This puts Germany in fifth place in the international ranking,” says Heinrich Meier, author of the BarthHaas report. “As in the previous year, places 1 to 4 are occupied by China, the USA, Brazil and Mexico. Together, the top 5 producing countries account for almost 50 percent of beer production internationally”.

According to the report, the European market declined slightly: a total of 511.1 million hectoliters of beer were produced there - 1.7 percent less than in the previous year. The decline was mainly due to lower production in the UK (-8.9 percent) and Poland (-5.3 percent). The countries of the rest of Europe ended the year better than the countries of the European Union, which lost an average of 2.5 percent in beer output; here, production remained almost stable at -0.1 percent.

The USA also had to accept a significant drop in 2023; beer production there fell by 5.6 percent to 193.0 million hl. This makes the United States the only producing country on the American continent with a decline. In Brazil and Mexico, by far the largest beer-producing countries in the Americas, beer production rose by one percent to 148.9 million hl and 142.4 million hl respectively. All countries in the Americas together produced 625.1 million hectoliters of beer, down 1.1 percent on the previous year.

Production in Asia declined to a similar extent at -1.0 percent, with the various markets developing in opposite directions in some cases. The winners included high-volume supplier countries such as India (+15.0 percent to 29.3 million hl) and Cambodia (+15.0 percent to 15.0 million hl), but they were unable to fully offset the losses in the even larger markets of China (-0.4 percent to 359.08 million hl), Japan (-1.2 percent to 45.3 million hl) and Vietnam (-20.5 percent to 31.0 million hl). Overall, Asia will account for a beer output of 574.3 million hl in 2023. 62.5 percent of this will come from China.

In percentage terms, Africa recorded the second largest increase in 2023, with output growing by 3.1 percent to a total of 154.5 million hl. South Africa contributed disproportionately to African production (+4.0 percent to 35.1 million hl). Ethiopia (+9.5 percent to 12.7 million hl) and Cameroon (+13.8 percent to 9.1 million hl) also showed strong growth. Only Australia/Oceania grew somewhat more strongly at +3.4 percent, although at 18.5 million hectoliters it is still at a very low level in terms of volume.

A forecast for the global beer market in 2024 is difficult to make. “The brewing industry is still feeling the effects of the war in Ukraine; companies along the entire supply chain are still suffering from high costs,” says Thomas Raiser, Managing Director of BarthHaas. “Consumers in many countries are groaning under the weight of high inflation. We therefore only expect beer output to remain stable this year, but there is no clear trend for the future.”

(* Some countries corrected their production figures after the publication of last year's BarthHaas report. As a result, the current figure is ten million hl or 0.5 percent higher than the figure reported for 2022).