While a dramatic reduction in the cost of agave will also enable producers to fund discounts in order to build market share, IWSR believes that brand owners will be wary of sacrificing their recently acquired brand equity by slashing prices.

Agave prices in Mexico hit a record MXP32/kg only 18 months ago, but by February 2024 they had plunged to MXP5/kg. Price falls are set to continue thanks to the huge numbers of new plants that have gone into the ground in the past few years (up by more than 10 percent between 2021 and 2022 alone), and the fact that agave takes several years to reach maturity. According to industry reports, the number of registered agave growers has more than quadrupled since 2018 as well.

“The very large inventory of agave plants, coupled with slowing demand of premium tequila segments in the US after years of rapid growth, has sparked a panic sale among amateur agave growers who have recently joined the industry in a bid to cash in on the agave spirits boom,” explains Jose Luis Hermoso, IWSR Research Director for Central and South America. “With such huge numbers of new plants going into the ground in 2021 and 2022, it’s entirely possible that pricing will not hit the bottom until 2026.”

Agave is similar to many long lead-time commodities in having an unbalanced production cycle: growers tend to overplant at times of high prices – as has been the case until very recently – which drives prices down as new plants come on stream. Lower prices then cause growers to underplant, diminishing supply and driving prices up again.

The cycle from peak to peak, or trough to trough, happens roughly every 10-15 years, or twice the agave maturity period. The last pricing trough occurred in 2007-10, when prices dropped as low as MXP2/kg.

At the same time, after several years of robust double-digit increases, overall tequila consumption volumes grew by only +4 percent in the US during the first half of 2023, according to IWSR data.

“Logically, we would expect to see an influx of cheaper 100% agave tequila into the market in the near future – so, potentially, a higher-quality product at a lower price, which might attract new consumers and/or encourage trade-down,” says Richard Halstead, IWSR COO for Consumer Research.

“The last time we saw a supply glut similar to this was around 2009/10, when numerous new brands came to the market using the 100 percent agave description, but at prices significantly lower than the majority of incumbent 100 percent agave brands.”

These launches increased the downward trajectory of mixto (51 percent agave) brands, which has continued since then – and could be exacerbated by the entry of new 100% agave brands offering a better price-to-quality ratio.

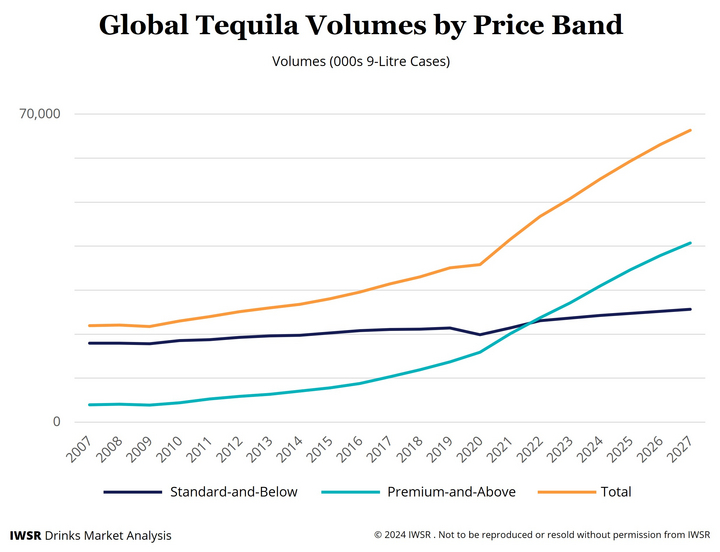

This need not signal the end of premiumisation for tequila. Longitudinal IWSR data covering the last agave pricing trough shows that, while global agave spirits volumes grew at a CAGR of +3 percent between 2006 and 2010, premium-plus volumes expanded at a CAGR of +7 percent over the same timescale – outstripping standard-and-below CAGR growth of +2 percent.

“While newer entrants are still falling into the approach of ‘buying at the peak/selling at the trough’, established players are trying to tame the cycle by underplanting during pricing peaks and overplanting during pricing troughs,” says Hermoso. “This can only be good for the agave spirits category in the longer term.”